Why market leaders use customer insights analytics! WHY vs. HOW

Customer insights, simply put, are knowledge and insights gained by looking at one’s own customer group.

Analysis of customer opinions enables understanding what drives target customers, what they expect from products and services, and what they need based on their preferences and challenges in the broader industry environment.

Customer Insights Analytics can help companies improve customer retention in their business units, make existing customer management more successful (up-/cross-selling) and evaluate new business options (innovations, trend prediction).

The right time is always NOW!

B2B companies have historically lagged their B2C counterparts in adopting and leveraging commercial CI analytics because they have been unable to leverage common social media monitoring and customer flow analytics tools without direct end-customer sales. AI-powered customer insights analytics can fill this vacuum.

Those B2B companies that are embracing customer insights and VoC (Voice of the Customer) are already outperforming their competitors. Their return on sales is up to five percentage points higher than that of their direct competitors. Market leaders have recognized: Proactive action knows only one right time, NOW!

In a 2021 McKinsey survey of more than 2,500 respondents in six countries and more than ten industries, 64 percent of B2B companies said they expect to increase their spending on predictive trend analytics or launch related investments in a timely manner.

Unfortunately, many mid-market companies still tend to be reactive and implement strategically important decisions later or only half-heartedly.

The problems start at the beginning of the process, when many companies struggle to define goals and use cases for the insights they want to gain, or to identify the right stakeholders within the company.

The start

Although most companies already have considerable amounts of data internally – which could be combined with an almost infinite amount of data from the public web – many companies lack the ability to transform, unify and finally analyze this data into relevant, usable insights and information carriers (topic Big Data vs. Data Slump).

Data that empowers them to sell more effectively, for example, by significantly improving their understanding of their customers’ experiences and needs.

It’s also not just B2B sales teams that are reluctant to accept new tools and integrate data collection and results into their “normal” sales operations. This is counterproductive, as it leaves companies without valuable information to occupy critical leads in the marketplace and fuel sales in a timely manner and into the future.

Without internal agreement on what real pain points exist, what to know about:

- one’s own target customer group,

- the customers’ view of one’s own products

- on those of competitors,

- as well as about the market in general (ecosystems)

and how to use these results proactively, there is a risk that companies waste resources and energies on tools that only deliver generic values.

Acting like market leaders!

Customer insights analytics can achieve a lot if it is used effectively.

First, a cross-functional, interdisciplinary team should be assembled as a task force: e.g., from the stakeholders of each product department (product owner), or from each business unit involved (marketing, product dev., sales,) to find out where the greatest value of insights lies for the respective department.

Once this is clarified, the task force exchanges ideas with executives to define milestones and targets, conserve internal resources, and focus on key areas.

After that, one to two real use cases should be defined, which can be implemented in a timely manner. Rapid experimentation and decision-making – similar to A/B testing – helps maximize internal learning and minimize costs.

The most promising use case is finally sponsored by the in-house executive whose team can benefit most quickly from the results. The implementation window should not exceed three to four months.

This way, values can be generated in a timely manner and they are clearly scalable – especially in larger SMEs or Enterprise companies.

WHY vs. HOW?

The difference lies in the approaches. What is being considered? Both sides are relevant. Let’s briefly introduce the approaches.

The HOW

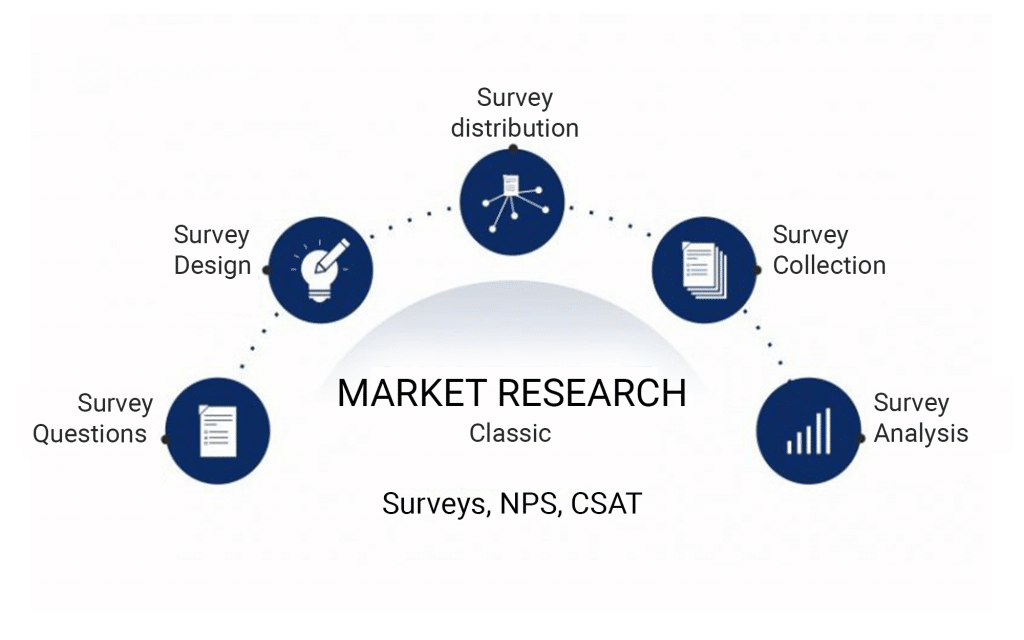

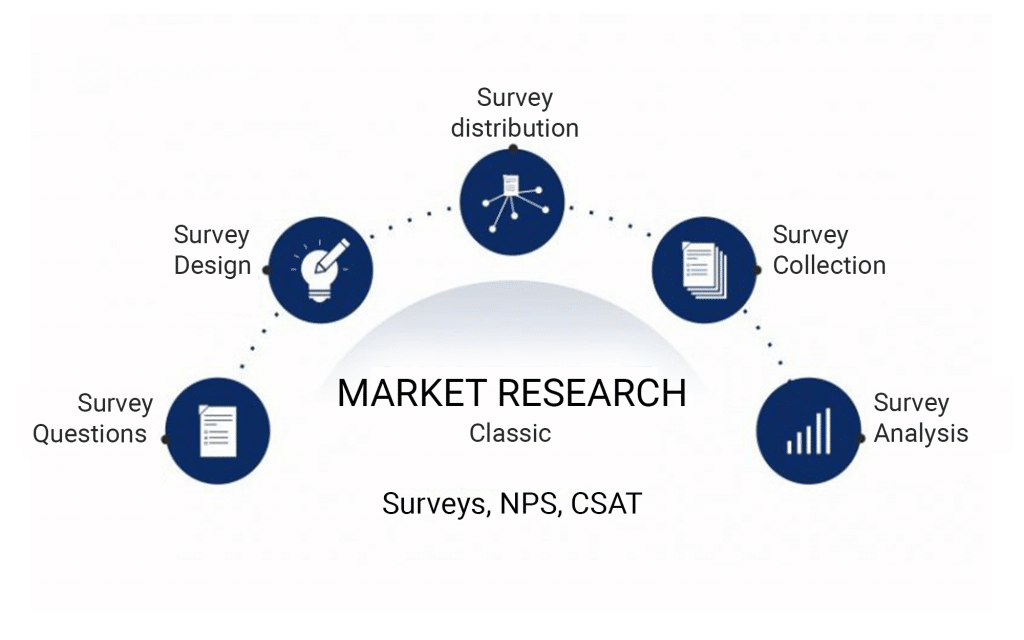

Market research, for example, uses surveys, polls and interviews to collect information about possible target customer groups, about customer profiles, important statistics about the status quo and more – mostly as a one-time markup.

The data that the commissioning company receives is cleanly prepared and trustworthy.

In classic market research, active surveys and interviews are usually used as a basis for this. The biggest problem with this methodology is that consumers are influenced to give answers that are considered socially desirable (social desirability bias) as well as during active questioning (interviewer bias).

It is hardly possible to find out the unbiased and uninfluenced “real” opinion of the target group through surveys and to classify these results as representative or even WHOLE. In addition, there are possible information gaps of the interviewed persons…

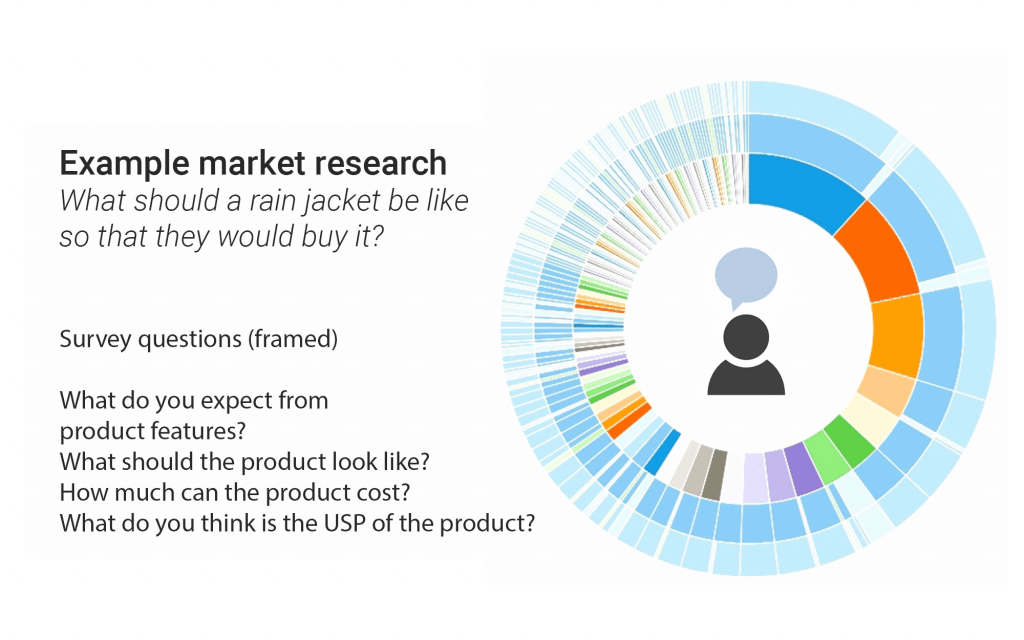

Example survey outdoor clothing:

If one asks customers, e.g. in the context of a customer survey about the ideal characteristics of a rain jacket, the customer probably lacks a comparison of all products available on the market.

The answers given therefore only refer to the respondent’s (in the best case) own experience and perspective with the product group under consideration or with a similar individual product. Are these meaningful enough? Are they “experienced” and transferable?

Qualitative findings from surveys and focus groups can be a FIRST starting point, but these results are difficult or impossible to link to other quantitative KPIs (such as conversion rate).

Market research is also generally expensive and only partially feasible for smaller SMEs and startups. A serious market research survey can cost 50 to 100k €, depending on the audience size. The report is ready after about 3 to 4 months, is a headline and only updateable with additional costs.

The WHY!

Customer Insights Analytics helps to get patterns regarding customers’ priorities, which have a direct impact on the purchase decision – quasi directly from the customer’s mouth – in his own “language”, based on experienced, own experiences with the product, with the service – unfiltered and unframed!

With the option to update this information at any time.

External customer feedback can be a powerful source of insights and feedback, as customers use it (e.g. via rating portals, online stores, social media, blogs and forums) to make informed decisions about a company’s product quality, cost and service level.

So far, this has mainly applied to B2C offerings, but it is also interesting for B2B companies.

External customer feedback in forums and blogs, for example, can also sharpen the focus for B2B companies on what users of their products expect from them, what they would like to see in the future, what would be possible and helpful features, and how trends can affect possible future demands of their business customers.

The classic B2B definition: “Our sales people already know what’s going on with the customers” doesn’t hold water – field and office sales people mostly talk to purchasing and the direct in-house customers (sponsors) of the customers. Rarely, however, with employees from product development or from the internal innovation hubs.

Customers listen to customers!

According to BrightLocal, 91% of people read online reviews and 84% trust reviews as much as a recommendation from a friend. As a result, they make a purchase decision quickly – 68% form their opinion after reading six or fewer reviews.

So, it pays to take customer feedback as seriously as any other customer channel.

After all, it is precisely this “freedom of distance” for the customer, as opposed to the clearly formulated interview questions of the “classic” methodology, that allows B2C and B2B customers to give their absolutely candid insights.

They write down what they like, what they don’t like, how they feel about products and services, which features they use or not and why.

How they experience the brand promise, how they evaluate this in context with competitor messages, and what companies might want to change about performance and perception.

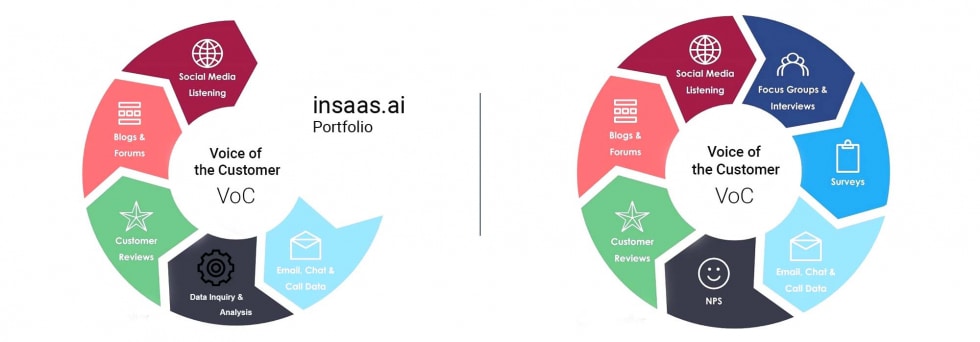

360* view!

Customer Insights Analytics does not question market research and its metrics or make them obsolete.

Rather, it is about holistically closing the loop of market research with the insights, the knowledge of buyers and users, of one’s own target customers about one’s own products and the overall market, about the entire ecosystem.

When a company puts the results of its own market research into context with tens or hundreds of thousands of customer voices from external and internal silos, the big picture emerges.

Conclusion

Internal and external data and customer feedback from a wide variety of silos, when aggregated and analyzed, can provide a comprehensive, first-hand look into the mindset and buying process of customers.

The data to look at is mostly already available (internally and externally on the public web – making the approach sustainable) and matching it with your own market research or end-customer analytics tools that may have already been done can complete this in a knowledge-effective, resource-saving and revenue-generating way.

Insaas.ai customers want to know how market research can be sustainably linked to the data-driven world of current online marketing or product development – agile or waterfall. Insaas.ai provides proactive support here and delivers real added value for the company in a timely manner.

B2B companies specifically benefit from this approach, since (as described above) they cannot use social media monitoring or customer flow analytics without direct end customer sales. Insaas.ai closes this gap with its customer insights analytics products Insaas.ai Geo Intelligence and Insaas.ai Product Insights.

With these products, companies can

- significantly improve customer retention in their business areas

- make existing customer management more successful (up-/cross-selling),

- evaluate new business or sales options (innovations, trend prediction),

- personalize the customer journey comprehensively and in line with customer needs,

- conserve resources and increase sales